Step1: Need to assign below responsibility to in User Account for Tax Setup Configuration

Responsibility:

Tax Managers

Step2: New Tax Setup for ‘FREMONT

CA-PARTIAL’

Tax Regime

Name: STATE TAX

Tax Regime: STATE TAX

Tax Name: FREMONT CA - PARTIAL

Tax

Jurisdiction: FREMONT

CA - PARTIAL

Tax Status: FREMONT CA - PARTIAL

Tax Rate

Code: FREMONT CA - PARTIAL

Tax

Classification: FREMONT CA - PARTIAL

Configuration

Owner: Global

Configuration Owner

Rate Type: Percentage

%Rate: 6.3125

Step1: Define Tax Regime:

(Note: No Need to perform Regime Setup If Regime Setup

already Exists)

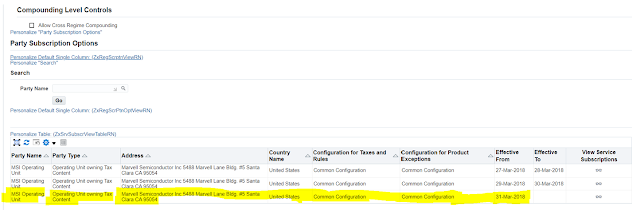

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Regime

Click

on Create Button.

Tax Regime: STATE TAX

Click on Apply.

Step2: Define Tax

Navigation: Tax Manager Responsibility > Tax Configuration >

Taxes

Click on Create Button.

Tax Name: FREMONT CA - PARTIAL

Click on ‘Tax Account’ button

Step3: Define Tax Jurisdictions

Navigation: Tax Manager Responsibility > Tax Configuration > Tax

Juridictions

Click

on Create Button

Step4: Define

Tax Statuses

Navigation: Tax Manager Responsibility > Tax Configuration > Tax

Statuses

Click on Create Button.

Step5: Define Tax Rates.

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Rates

Click

on Create Button

Configuration

Owner: Global Configuration Owner

Tax Rate Code: FREMONT CA - PARTIAL

Rate Type:

Percentage

%Rate: 6.3125

Click on Rate

Details Icon.

Tax Rate Detail:

Tax Rate

Name: FREMONT CA - PARTIAL

Tax Rate

Description: FREMONT CA - PARTIAL

Click on Apply.

Tax Account:

Click on Tax

Account Icon.

Step6: Define Tax Rule

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Rules

Need to Search with

Configuration Owner: Global

Configuration Owner

Tax Regime: STATE TAX

Tax Name: FREMONT CA - PARTIAL

Need to update the following details.

Determine Tax

Status: FREMONT CA - PARTIAL

Determine Tax

Rate: FREMONT CA - PARTIAL

Determine

Taxable Basis: STANDARD_TB

Calculate Tax

Amounts: STANDARD_TC

Tax Rule Code: P2P_TAX_CODE_NOT_APPLY_OM

Name: P2P_TAX_CODE_NOT_APPLY_OM

Click on Next

Location Type:

Bill To

Geography Type:

Country

Operator: Not

equal to

Value: Afghanistan

Click on Next

Click on Next

Determining

Factor Set: FCP_DFS_P2P_1

Name: FCP_DFS_P2P_1

Condition

Set: FCP_CS_P2P_1

Name: FCP_CS_P2P_1

Click on Finish.

Click on Pencil

Icon.

Select Enable

Checkbox

Click on Next

& Finish.

Step7: Now

we Need to Enable Tax.

Navigation: Tax Manager Responsibility > Tax Configuration > Taxes

Country: United

States

Regime: STATE TAX

Tax Rate Name: FREMONT CA - PARTIAL

Search with above values

Click on Update

Button.

Enable the Checkbox and click on Apply

Now we can test

the Tax Setup on Purchase Order Transaction.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.