select dbms_metadata.get_ddl('VIEW','

Tuesday, 28 November 2023

Oracle EBS SQL Query - To Get the Object Source Code

Friday, 17 November 2023

Oracle EBS - SQL Query to get Inventory Interface Manager Status

SELECT

x.process_type "Name",

decode((

SELECT

'1'

FROM

apps.fnd_concurrent_requests cr, apps.fnd_concurrent_programs_vl cp, apps.fnd_application a

WHERE

cp.concurrent_program_id = cr.concurrent_program_id

AND cp.concurrent_program_name = x.process_name

AND cp.application_id = a.application_id

AND a.application_short_name = x.process_app_short_name

AND phase_code != 'C'

AND ROWNUM = 1

),

'1',

'Active',

'Inactive') "Status",

x.worker_rows "Worker Rows",

x.timeout_hours "Timeout Hours",

x.timeout_minutes "Timeout Minutes",

x.process_hours "Process Interval Hours",

x.process_minutes "Process Interval Minutes",

x.process_seconds "Process Interval Seconds"

FROM

(

SELECT

mipc.process_code,

mipc.process_status,

mipc.process_interval,

mipc.manager_priority,

mipc.worker_priority,

mipc.worker_rows,

mipc.processing_timeout,

mipc.process_name,

mipc.process_app_short_name,

a.meaning process_type,

floor(mipc.process_interval / 3600) process_hours,

floor((mipc.process_interval -(floor(mipc.process_interval / 3600) * 3600)) / 60) process_minutes,

( mipc.process_interval - ( floor(mipc.process_interval / 3600) * 3600 ) - ( floor((mipc.process_interval -(floor(mipc.

process_interval / 3600) * 3600)) / 60) * 60 ) ) process_seconds,

floor(mipc.processing_timeout / 3600) timeout_hours,

floor((mipc.processing_timeout - floor(mipc.processing_timeout / 3600) * 3600) / 60) timeout_minutes

FROM

apps.mtl_interface_proc_controls mipc,

apps.mfg_lookups a

WHERE

a.lookup_type = 'PROCESS_TYPE'

AND a.lookup_code = mipc.process_code

) x

-- WHERE x.PROCESS_TYPE = 'Cost Manager' -- uncomment this to display only the cost manager; Possible Values: Cost Manager; Lot Move Transaction; Material transaction; Move transaction

ORDER BY

1;

Saturday, 11 November 2023

Oracle EBS - SQL Query to check Purchase Order Receipt Routing Type

TABLE: RCV_TRANSACTIONS

COLUMN: ROUTING_HEADER_ID

VALUES:

1 (Standard Receipt),

2 (Inspection Required) And

3 (Direct Delivery).

SQL Query:

SELECT pha.segment1 po_number,

pla.line_num po_line_number,

pra.release_num po_release_number,

rsh.receipt_num receipt_number,

decode(rt.routing_header_id,1,'Standard Receipt', 2, 'Inspection Required', 3, 'Direct Delivery',null) Receipt_Routing,

msik.concatenated_segments item_number,

msik.description,

rs.unit_of_measure,

rs.item_revision,

rs.receipt_date,

plla.quantity total_quantity,

rs.quantity quantity_to_inspect,

plla.quantity_received,

plla.quantity_accepted,

plla.quantity_rejected,

rt.vendor_lot_num,

rt.comments vendor_serial_num,

rsh.bill_of_lading customs_number,

rsh.comments customs_date,

rt.attribute1 manufactured_date,

rs.po_line_id,

rs.po_header_id,

rs.po_release_id,

rs.po_line_location_id,

rs.shipment_header_id,

rs.shipment_line_id,

rs.rcv_transaction_id,

rs.item_id,

rs.to_organization_id,

rs.supply_source_id,

mp.organization_code

FROM apps.rcv_supply rs,

apps.mtl_system_items_kfv msik,

apps.po_headers_all pha,

apps.po_lines_all pla,

apps.po_releases_all pra,

apps.po_line_locations_all plla,

apps.rcv_transactions rt,

apps.rcv_shipment_headers rsh,

apps.mtl_parameters mp

WHERE rs.to_organization_id = mp.organization_id

AND mp.organization_code IN ('SKO', 'TIF', 'TIS', 'TIW')

AND rs.supply_type_code = 'RECEIVING'

AND rs.po_header_id = pha.po_header_id

AND msik.inventory_item_id = rs.item_id

AND msik.organization_id = rs.to_organization_id

AND rs.po_line_id = pla.po_line_id

AND rs.po_release_id = pra.po_release_id(+)

--AND TRUNC(rs.receipt_date) = TRUNC(SYSDATE)

AND rs.po_line_location_id = plla.line_location_id

AND rs.rcv_transaction_id = rt.transaction_id

AND rt.transaction_type = 'RECEIVE'

AND rt.inspection_status_code = 'NOT INSPECTED'

AND rs.shipment_header_id = rsh.shipment_header_id

-- AND pha.segment1='333428'

-- AND rt.routing_header_id=2 -- 1 (Standard receipt), 2 (Inspection required) and 3 (Direct delivery)

ORDER BY 9,

5,

1,

2,

4;

Monday, 9 October 2023

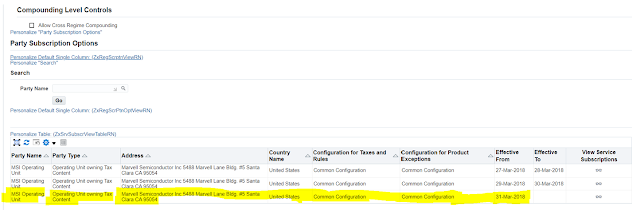

Oracle EBS - How to Enable New Tax Setup

Step1: Need to assign below responsibility to in User Account for Tax Setup Configuration

Responsibility:

Tax Managers

Step2: New Tax Setup for ‘FREMONT

CA-PARTIAL’

Tax Regime

Name: STATE TAX

Tax Regime: STATE TAX

Tax Name: FREMONT CA - PARTIAL

Tax

Jurisdiction: FREMONT

CA - PARTIAL

Tax Status: FREMONT CA - PARTIAL

Tax Rate

Code: FREMONT CA - PARTIAL

Tax

Classification: FREMONT CA - PARTIAL

Configuration

Owner: Global

Configuration Owner

Rate Type: Percentage

%Rate: 6.3125

Step1: Define Tax Regime:

(Note: No Need to perform Regime Setup If Regime Setup

already Exists)

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Regime

Click

on Create Button.

Tax Regime: STATE TAX

Click on Apply.

Step2: Define Tax

Navigation: Tax Manager Responsibility > Tax Configuration >

Taxes

Click on Create Button.

Tax Name: FREMONT CA - PARTIAL

Click on ‘Tax Account’ button

Step3: Define Tax Jurisdictions

Navigation: Tax Manager Responsibility > Tax Configuration > Tax

Juridictions

Click

on Create Button

Step4: Define

Tax Statuses

Navigation: Tax Manager Responsibility > Tax Configuration > Tax

Statuses

Click on Create Button.

Step5: Define Tax Rates.

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Rates

Click

on Create Button

Configuration

Owner: Global Configuration Owner

Tax Rate Code: FREMONT CA - PARTIAL

Rate Type:

Percentage

%Rate: 6.3125

Click on Rate

Details Icon.

Tax Rate Detail:

Tax Rate

Name: FREMONT CA - PARTIAL

Tax Rate

Description: FREMONT CA - PARTIAL

Click on Apply.

Tax Account:

Click on Tax

Account Icon.

Step6: Define Tax Rule

Navigation: Tax Manager Responsibility

> Tax Configuration > Tax Rules

Need to Search with

Configuration Owner: Global

Configuration Owner

Tax Regime: STATE TAX

Tax Name: FREMONT CA - PARTIAL

Need to update the following details.

Determine Tax

Status: FREMONT CA - PARTIAL

Determine Tax

Rate: FREMONT CA - PARTIAL

Determine

Taxable Basis: STANDARD_TB

Calculate Tax

Amounts: STANDARD_TC

Tax Rule Code: P2P_TAX_CODE_NOT_APPLY_OM

Name: P2P_TAX_CODE_NOT_APPLY_OM

Click on Next

Location Type:

Bill To

Geography Type:

Country

Operator: Not

equal to

Value: Afghanistan

Click on Next

Click on Next

Determining

Factor Set: FCP_DFS_P2P_1

Name: FCP_DFS_P2P_1

Condition

Set: FCP_CS_P2P_1

Name: FCP_CS_P2P_1

Click on Finish.

Click on Pencil

Icon.

Select Enable

Checkbox

Click on Next

& Finish.

Step7: Now

we Need to Enable Tax.

Navigation: Tax Manager Responsibility > Tax Configuration > Taxes

Country: United

States

Regime: STATE TAX

Tax Rate Name: FREMONT CA - PARTIAL

Search with above values

Click on Update

Button.

Enable the Checkbox and click on Apply

Now we can test

the Tax Setup on Purchase Order Transaction.

Tuesday, 12 September 2023

Oracle EBS - PLSQL Script to check Chart of Account is restricted by which Cross Validation Rule

Subject: PLSQL Script to check Chart of Account Is Restricted by which Cross Validation Rule.

---PLSQL Code---

SET SERVEROUTPUT ON SIZE 1000000;

DECLARE

p_conc_segments VARCHAR2(200) := '47.2020.65100.00.000.0000' ;

--'&Conc_Segments';

p_accounting_flex VARCHAR2(100) := 'Accounting Flexfield';

--'&Flex_Structure';

CURSOR c_flex_rules(cp_id_flex_num NUMBER)

IS

SELECT

R.flex_validation_rule_name rule_name,

T.error_message_text error_message,

nvl(to_number(to_char(R.start_date_active,'J')), 0) start_date,

nvl(to_number(to_char(R.end_date_active,'J')), 0) end_date,

L.include_exclude_indicator IE_indicator,

L.concatenated_segments_low segments_low,

L.concatenated_segments_high segments_high

FROM

fnd_flex_validation_rule_lines L,

fnd_flex_validation_rules R,

FND_FLEX_VDATION_RULES_TL T

WHERE

R.enabled_flag = 'Y' AND

L.enabled_flag = R.enabled_flag AND

R.application_id = L.application_id AND

R.application_id = T.application_id AND

R.flex_validation_rule_name = L.flex_validation_rule_name AND

R.flex_validation_rule_name = T.flex_validation_rule_name AND

R.application_id = 101 AND

R.id_flex_num = L.id_flex_num AND

R.id_flex_num = T.id_flex_num AND

R.id_flex_num = cp_id_flex_num AND

R.id_flex_code = L.id_flex_code AND

R.id_flex_code = T.id_flex_code AND

T.language = 'US' AND

R.id_flex_code = 'GL#' AND

trunc(nvl(R.start_date_active, sysdate)) <= trunc(sysdate) AND

trunc(nvl(R.end_date_active, sysdate+1)) > trunc(sysdate)

ORDER BY

R.flex_validation_rule_name asc, L.Include_Exclude_Indicator desc;

v_flex_rule c_flex_rules%ROWTYPE;

v_delimiter VARCHAR2(1);

v_id_flex_num NUMBER;

v_invalid BOOLEAN;

v_seg_count NUMBER;

v_segment VARCHAR2(100);

v_segments FND_FLEX_EXT.SegmentArray;

v_segments_low FND_FLEX_EXT.SegmentArray;

v_segments_high FND_FLEX_EXT.SegmentArray;

v_temp NUMBER;

i NUMBER;

v_rule_name

fnd_flex_vdation_rules_vl.flex_validation_rule_name%TYPE;

v_intro VARCHAR2(100);

v_result VARCHAR2(2000);

CRLF VARCHAR2(1) := CHR(10);

BEGIN

v_intro := CRLF||'For flex structure

"'||p_accounting_flex||'" the combination '||CRLF||'"'||p_conc_segments||'"';

v_result := ' ';

BEGIN

SELECT concatenated_segment_delimiter, id_flex_num

INTO v_delimiter, v_id_flex_num

FROM fnd_id_flex_structures FS

WHERE

application_id = 101 AND

id_flex_code = 'GL#' AND

id_flex_num =

(SELECT min(id_flex_num)

FROM fnd_id_flex_structures_tl

WHERE

application_id = 101 AND

id_flex_code = 'GL#' AND

id_flex_structure_name = p_accounting_flex);

EXCEPTION

WHEN NO_DATA_FOUND THEN BEGIN

raise_application_error(-20001, 'Unable to locate the flex structure

data.');

END;

END;

v_seg_count :=

FND_FLEX_EXT.Breakup_Segments (p_conc_segments, v_delimiter, v_segments);

OPEN c_flex_rules(v_id_flex_num);

FETCH c_flex_rules INTO v_flex_rule;

<<rule_cursor>>

LOOP

EXIT WHEN c_flex_rules%NOTFOUND;

v_temp := FND_FLEX_EXT.Breakup_Segments (v_flex_rule.segments_low,

v_delimiter, v_segments_low);

v_temp := FND_FLEX_EXT.Breakup_Segments (v_flex_rule.segments_high,

v_delimiter, v_segments_high);

i

:= 1;

IF

v_flex_rule.IE_indicator = 'I' THEN

v_rule_name := v_flex_rule.rule_name;

v_invalid := FALSE;

<<include>>

WHILE v_flex_rule.rule_name = v_rule_name AND -- cycle on Include lines

of a rule

v_flex_rule.IE_indicator = 'I' AND

NOT v_invalid AND -- until one Include line is found

c_flex_rules%FOUND LOOP -- including the cc in question

v_invalid := FALSE;

FOR i IN 1 .. v_seg_count LOOP

v_segment := v_segments(i);

IF v_segments(i) NOT BETWEEN v_segments_low(i) AND v_segments_high(i)

THEN

v_invalid := TRUE;

END IF;

END LOOP;

FETCH c_flex_rules INTO v_flex_rule;

v_temp := FND_FLEX_EXT.Breakup_Segments (v_flex_rule.segments_low,

v_delimiter, v_segments_low);

v_temp := FND_FLEX_EXT.Breakup_Segments (v_flex_rule.segments_high,

v_delimiter, v_segments_high);

END LOOP include;

IF v_invalid THEN

v_result := v_result ||CRLF||'Not included in

"'||v_rule_name||'" rule.';

END IF;

ELSE

<<exclude>>

LOOP

v_segment := v_segments(i);

EXIT exclude WHEN v_segments(i) NOT BETWEEN v_segments_low(i) AND

v_segments_high(i);

IF (i = v_seg_count) THEN

v_result := v_result ||CRLF||'Excluded by

"'||v_flex_rule.rule_name||'" rule.';

v_invalid := TRUE;

EXIT exclude;

END IF;

i := i + 1;

END LOOP exclude;

FETCH c_flex_rules INTO v_flex_rule;

END IF;

END LOOP rule_cursor;

IF v_result <> ' ' THEN

dbms_output.put_line( v_intro ||' is ' ||v_result );

ELSE

dbms_output.put_line( v_intro||' does not violate any cross-validation

rules.');

END IF;

EXCEPTION

WHEN OTHERS THEN

raise_application_error(-20002, SQLERRM);

END;

/

Output: